Banks could close more high-profile accounts under legislation to tackle economic crime and protect national security

- Lawyer Jeremy Asher said accounts could be shut for national security reasons

- It comes after Nigel Farage’s Coutts account was closed by owner Natwest

Banks could shut down even more high-profile accounts under new legislation designed to tackle economic crime and protect national security, an expert has warned.

The increasing use of artificial intelligence and heightened sensitivity around fraud will also see prominent customers having their accounts closed without any warning or explanation, lawyer Jeremy Asher said.

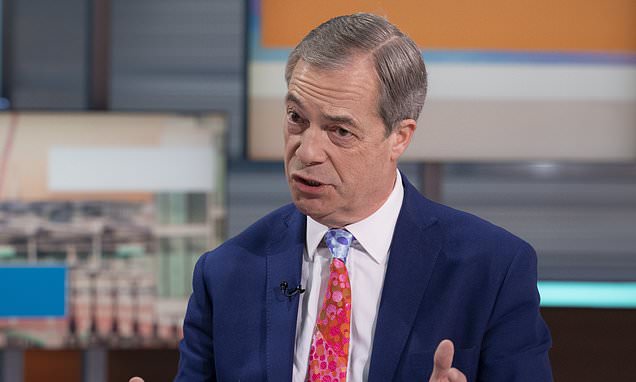

Leading Brexiteer Nigel Farage revealed last week that his account was shut down after prestigious private bank Coutts found his views did ‘not align’ with their own values.

Chancellor Jeremy Hunt is among the well-known figures to have had bank accounts closed or denied after facing increased scrutiny from lenders.

Under new laws to be enforced after summer recess, the Treasury says it will now compel banks to explain – and delay – any decision to close an account.

Leading Brexiteer Nigel Farage (pictured) revealed last week that his account was shut down after prestigious private bank Coutts found his views did ‘not align’ with their own values

READ MORE: Banks bosses will be hauled in front of ministers to warn them about ‘de-banking’ after scandal where Nigel Farage’s Coutts account was closed

Mr Farage saw his account shut down following a meeting of Coutts’ Reputation Risk Committee, which found his political views did not align with the bank’s.

But experts have suggested the new law could see anyone with ‘adverse press’ around them due to controversial or divisive views swiftly de-banked without the need for a human to scrutinise and sign off the findings.

Mr Asher, a solicitor with law firm Setfords, warned the Government’s new Economic Crime and Corporate Transparency Bill may make the problem even worse.

He said: ‘It will prosecute organisations who fail to prevent fraud – this legislation goes against the banks rather than the fraudsters themselves.

‘The idea of banks shutting down free speech is becoming an issue. As they become more risk averse, they will rely more on flawed automated processes rather than taking an individual, human view on it.

‘We know that the AI and automated tools in use are not perfect, so it stands to reason that the banks are going to be less likely to allow their staff to use its discretion to override a negative result from the screening, or to remove fraud markers where they have already been loaded.’

Senior City sources have expressed concerns about the legislation, which is currently making its way through the House of Lords.

One warned that banks ‘by their very nature are now extremely risk averse’.

One Parliamentary source familiar with the legislation noted: ‘Banks are becoming more risk averse generally, and tighter controls could affect that.’

The number of ‘fraud markers’ placed against customer’s names has risen dramatically in recent years.

Some 305,000 were uploaded to the Cifas national fraud database used by banks in 2017.

‘These systems are not perfect,’ Mr Asher said. ‘A third of appealed cases are overturned by the Ombudsman.

‘This issue really came to a head when the Chancellor was rejected by Monzo. There needs to be more time spent on decisions.’

Consumer group Which? has also warned that some banks are wrongly closing customers’ accounts or applying markers which could affect their ability to access finance.

Sam Richardson, deputy editor of Which? Money, said: ‘Having your bank account closed without warning can be an incredibly stressful experience – not least at a time when millions of households are struggling to pay the bills.

‘Which? is concerned that some banks are wrongly closing customers’ accounts or handing them Cifas markers which can affect their ability to access other financial products for years.’

A Home Office spokesperson said: ‘The Failure to Prevent Fraud offence has been created to ensure large organisations actively seek to prevent their employees from committing fraud for the benefit of the company.

‘It does not provide grounds for a bank to close a customer’s bank account on ideological grounds.

‘The Economic Crime and Corporate Transparency Bill will additionally bear down on kleptocrats, criminals and terrorists who abuse our financial system, strengthening the UK’s reputation as a place where legitimate business can thrive.’