SINGAPORE – Amid the Covid-19 pandemic, the number of transactions using the SingPass national authentication system, as well as the number of SingPass app users, has increased sharply.

Transactions facilitated by SingPass last year doubled to over 170 million, as more people turned to digital transactions during the pandemic, the Government Technology Agency (GovTech), which developed the system, said on Thursday (March 4).

SingPass is used to access government e-services, including checking Central Provident Fund balances and applying for public housing.

It now powers more than 1,400 services offered by over 340 public and private sector organisations.

The number of people using the SingPass mobile app also tripled in the past year to 2.5 million, of which over 90 per cent use the app at least once a month. The SingPass app was one of the most downloaded ones here last year, said GovTech.

The agency added that SingPass has “played an important role in the fight against Covid-19” and has supported pandemic contact tracing efforts with SafeEntry check-ins through the SingPass app.

GovTech gave this update as it launched a new logo for SingPass, a first in the 18 years since the service was introduced in 2003. The SingPass website and app will be updated with the new logo from Sunday.

At the heart of this rebranding is delivering an “even better SingPass that offers new features and provides convenient access to a larger range of services”, said GovTech.

The agency noted that in the last three years, more than 10 features have been added to SingPass.

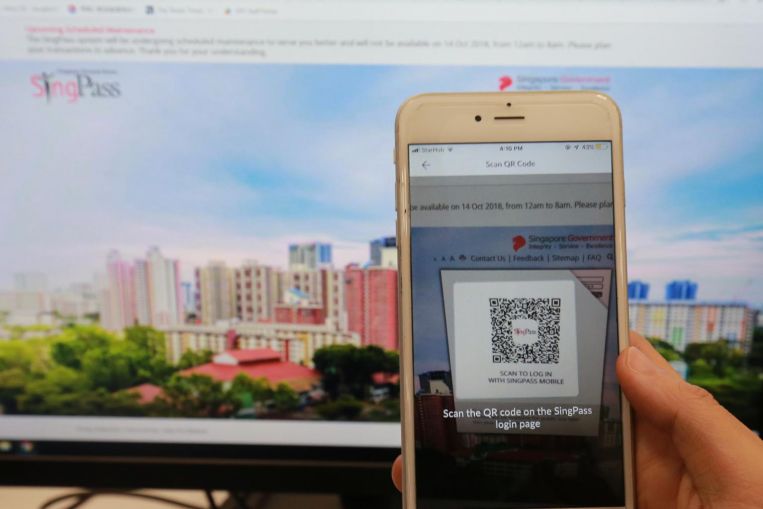

These include the launch of the SingPass app in 2018 and upgrading SingPass to the digital equivalent of the NRIC. This means that, in some cases, the SingPass app can replace the physical NRIC to verify a person’s identity, or reduce the need to fill in personal details with forms.

The SingPass app stores, in one place, a user’s NRIC barcode and personal details such as driver’s licence number, marriage certificate number, birth records of children, property ownership data and Central Provident Fund records.

Using the SingPass app to access these personal details or online government services is secured by the user having to key in a six-digit passcode into the app, or confirming with biometrics by scanning a fingerprint or the face with the app.

This is possible after the user has already keyed in his username and password to set up the app.

One example of using SingPass to verify a person’s identity is registering at Punggol Polyclinic. A person can launch his SingPass app, use it to scan a QR code at the polyclinic, then verify his identify with the app by keying in his six-digit passcode or using a biometric scan.

In future, the SingPass app could also be used for age verification to sell alcoholic beverages from vending machines. This is similarly done by scanning a QR code and then authenticating with a person’s passcode or biometric scan with the app to confirm he has reached the legal age to buy alcohol.

GovTech noted that using SingPass for customer log-ins “removes the need for organisations to maintain their own authentication platforms”. Users can also “avoid the hassle of managing many different sets of credentials”.

In December last year, the agency also announced a new feature that allows SingPass to be used for two-factor authentication by scanning a person’s face.

This Face Verification feature has also been used by DBS Bank to allow small and medium-sized enterprise owners to face a camera to authenticate and verify their information while setting up a corporate account online with the bank.

Another new SingPass feature is Sign, which was launched last November. It allows users to sign legal and business documents virtually.

A person can do this by using the SingPass app to scan a unique QR code for an online document ready for signing on his computer, then scanning the face or fingerprint with the app to authenticate and complete the digital signing.

The signature is encrypted and identity is automatically validated against the government’s database at the point of signing.

GovTech said on Thursday that “digitalising everyday transactions saves time for both residents and businesses as users no longer have to submit hardcopy documents and streamlined processes result in quicker approvals for applications”.

To ensure SingPass services are easily accessible, the agency added that key transaction pages on the SingPass website and app will be available in the four official languages – English, Chinese, Malay and Tamil – by the end of this year.

Users without smartphones will also be able to authenticate with SingPass by receiving a one-time password through SMS, or by scanning their faces with the SingPass Face Verification feature on Web browsers or at kiosks.

Mr Kwok Quek Sin, GovTech’s senior director for National Digital Identity, said the agency would continue to roll out new products and features on the SingPass national digital identity platform.

“The new (SingPass) brand offers an exciting glimpse into the possibilities and future of our Smart Nation – one that is enabled by the trusted national digital identity, a platform which we can rely on for all of our transactions,” said Mr Kwok.

Join ST’s Telegram channel here and get the latest breaking news delivered to you.

Source: Read Full Article