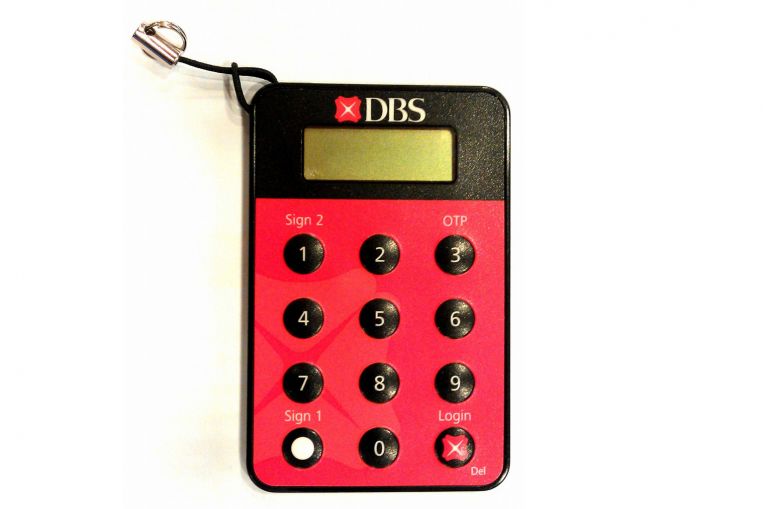

DBS Bank customers will no longer be able to use their physical tokens to access mobile and digital banking services from April 1, with the bank to stop issuing these tokens on Feb 1.

This means that users will be required to use the bank’s digital token, which can be set up via the DBS digital banking app, to authenticate all banking transactions.

Unlike the physical token, which is a separate device, the digital token operates within the digital banking app on users’ smartphones. It is otherwise identical in function.

The bank said the digital token saves users the hassle of having to replace physical tokens that usually run out of power after about five years.

The bank started progressively replacing the use of physical tokens with the digital version three years ago.

DBS said yesterday that a “large majority” of its active digital banking users are already using digital tokens.

It is not known how many users are still using the bank’s physical tokens. DBS has more than three million mobile banking users in total.

DBS head of consumer banking Jeremy Soo said feedback has been positive, with customers appreciating the “added convenience” of the digital tokens.

“As more customers take to mobile banking, our aim is to ensure that access to our services is as seamless and fuss-free as possible, without compromising on security,” he said.

“Digital tokens save customers the hassle of carrying around a physical token, and of being unable to access our online or mobile services should customers accidentally misplace them.”

UOB was the first bank here to introduce digital tokens to customers in 2016, while OCBC Bank launched its digital token in 2019.

UOB and OCBC stopped issuing physical tokens in 2018 and 2019 respectively, although both said customers can still request physical tokens should they want to.

“Some customers may opt for physical tokens if they are using an older mobile device that does not support the minimum operating system requirements of the UOB Mighty app, requirements which are in place to protect customers from cyberthreats,” said UOB head of group personal financial services Jacquelyn Tan.

About 85 per cent of the bank’s active app users are using digital tokens, she added.

OCBC vice-president of digital business Andrew Chang said the bank has made a “concerted effort” to nudge its customers to adopt digital tokens, with more than half of its active digital users using digital tokens now.

• Guides on how DBS customers can set up their digital tokens can be found at http://www.dbs.com.sg/digitaltoken

Join ST’s Telegram channel here and get the latest breaking news delivered to you.

Source: Read Full Article