While Congress remains gridlocked on the next relief deal, Americans know what they want: A second round of stimulus checks, please. Liability protections and student loan forbearance can wait.

Two in three Americans said stimulus checks were the most important provision of the next relief deal, according to the latest Yahoo Finance-Harris Poll of 2,027 people, while fewer than 1 in 4 (23%) support the liability protection for businesses and only 1 in 5 back student loan payment deferrals.

“The liability shield just doesn’t make sense to people. People don’t understand why that would be a priority,” Gbenga Ajilore, a senior economist at the Center for American Progress, a nonprofit for public policy research and advocacy, told Yahoo Money. “A liability shield is not going to put food on the table, it’s not going to keep people in their homes.”

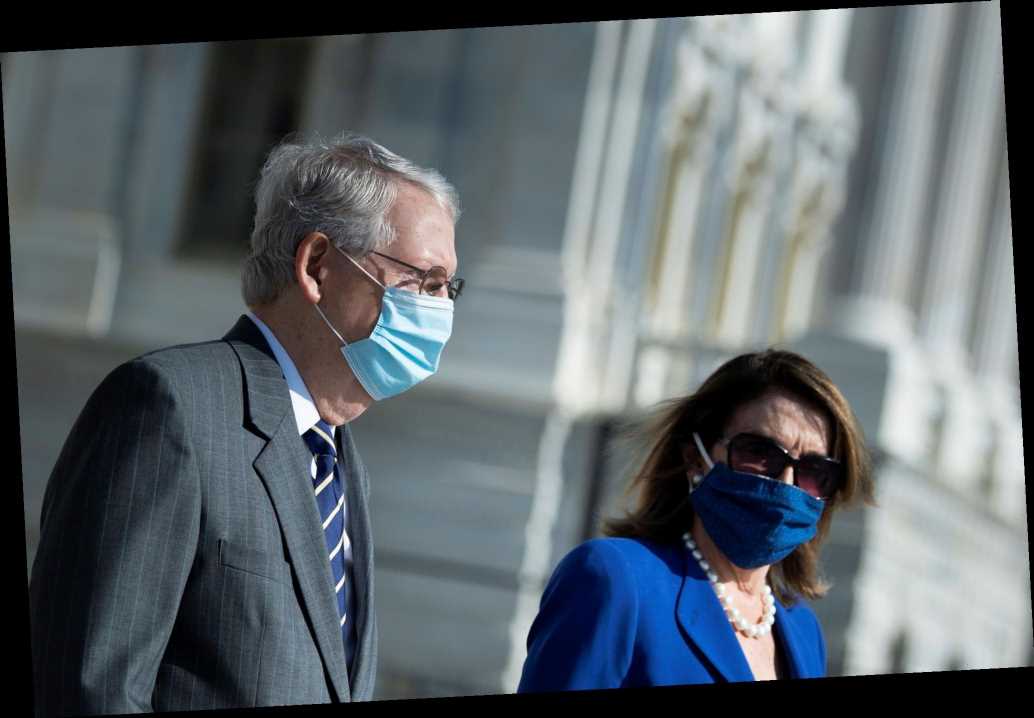

The liability shield would protect businesses, educational institutions, and other employers from coronavirus-related claims from workers who get sick while regularly going to work. It’s what Senate Majority Leader Mitch McConnell called a “red line” for Republicans during stimulus negotiations, but could be left out of the next deal if Democrats agree to nix their key provision — aid for state and local governments.

Not only are stimulus checks the most important provision for Americans, but they should be included in the next deal, according to 7 in 10 of respondents from a second round of polling of 1,026 people. Under the CARES Act, around 160 million Americans received a stimulus payment of up to $1,200 — plus $500 for any child dependent.

Two of the main proposals on the negotiating table — McConnell’s (R-KY) around $500 billion package and the Democrat-backed $908 billion bipartisan proposal — don’t include a provision on direct payments. The White House’s $916 billion proposal is the only one that includes checks, but leaves out supplemental unemployment benefits, which Democratic leaders called “unacceptable.”

There’s also a standalone bill on direct payments introduced by Sen. Josh Hawley (R-MO) and Sen. Bernie Sanders (I-VT). But experts said it may not have enough votes to become law if a bigger deal on stimulus is not reached.

‘Saved money won’t last long when nothing’s coming in’

Nearly 7 in 10 Americans expected and budgeted in the hopes that Congress would pass another bill providing extra financial aid between August and now, the poll also found.

“It wasn’t an unreasonable assumption that Congress would pass some sort of relief,” Ajilore said. “What’s unreasonable is the fact that they haven’t.”

Nearly nine months after the CARES Act passed, many of its provisions have expired or are set to expire if no stimulus deal is reached by the end of the year.

Up to 12 million Americans are expected to lose unemployment benefits coverage when two programs enacted under the act expire on December 26. Additionally, the federal eviction moratorium, paid sick leave, aid to state and local governments, among other relief, will lapse.

“If people had known that Congress was going to be derelict in their duty, and not provide any relief after the CARES Act, people would have done things a lot more differently,” Ajilore said. “Still, people saved their money, but saved money won’t last long when nothing’s coming in.”

‘Certain people are going to struggle a lot more’

More than half of respondents (53%) say they’ll need more than seven months for their household finances to return to pre-pandemic levels, with 1 in 3 saying it may take more than a year, the survey found.

“Certain people are going to struggle a lot more,” Alijore said. “People are taking on more debt now, because they have to pay the bills.”

More than a third of Americans (33.9%) reported they’ve had a somewhat to very difficult time paying basic household expenses in the first week of November, according to a recent report by the Census Bureau released last week.

While jobless workers more than doubled their liquid savings between March and July, according to a study from the JPMorgan Chase Institute, they spent two-thirds of those accumulated funds in August alone. That occurred as the extra $600 in weekly unemployment benefits expired at the end of July, followed by the September expiration of the extra $300 under the Lost Wages Assistance program.

“This is going to be really tough for them,” Alijore said. “The more debt you take on, the further it is going to be before you can become whole again.”

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

-

Stock market highs, booming housing, and millions unemployed: A tale of two Americas amid the coronavirus pandemic

-

Up to 15 million Americans face a devastating loss of pandemic stimulus ‘the day after Christmas’

-

Read more personal finance information, news, and tips on Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit

Source: Read Full Article