For almost a decade, the government took hundreds of dollars each month out of the paychecks of a Florida woman named Michelle to recoup old student loans that were unpaid and overdue. The process, called garnishment, is legal, and the U.S. Department of Education can order it for someone’s wages, tax returns and Social Security to force repayment on defaulted loans.

Michelle’s garnishment began in 2008. As a public school teacher in Orlando, who asked to be identified by her first name only because this story involves her personal finances, she struggled for the next eight or nine years to make ends meet while supporting her two children.

“I almost lost my house and everything over this because I just couldn’t afford it,” she said. And with roughly $800 per month suddenly gone, Michelle recalled at times facing impossible decisions day to day: “I’ve got to consider, ‘Do we get this meal or do we keep the lights on? Which is more important right now?'”

After the garnishment period ended, Michelle believed that her student debts were paid in full. But, this past spring, she started receiving notices about a different loan, which she borrowed through the now-defunct Perkins Loan Program while pursuing an undergraduate degree at the University of Florida.

The program offered low-interest federal loans to undergraduate and graduate students with “exceptional financial need,” according to the Department of Education, and is now being phased out since officially closing in September 2017. Michelle applied for loan forgiveness through the Perkins program after graduating from the University of Florida in 1997, and later satisfied the teaching service requirements to get it.

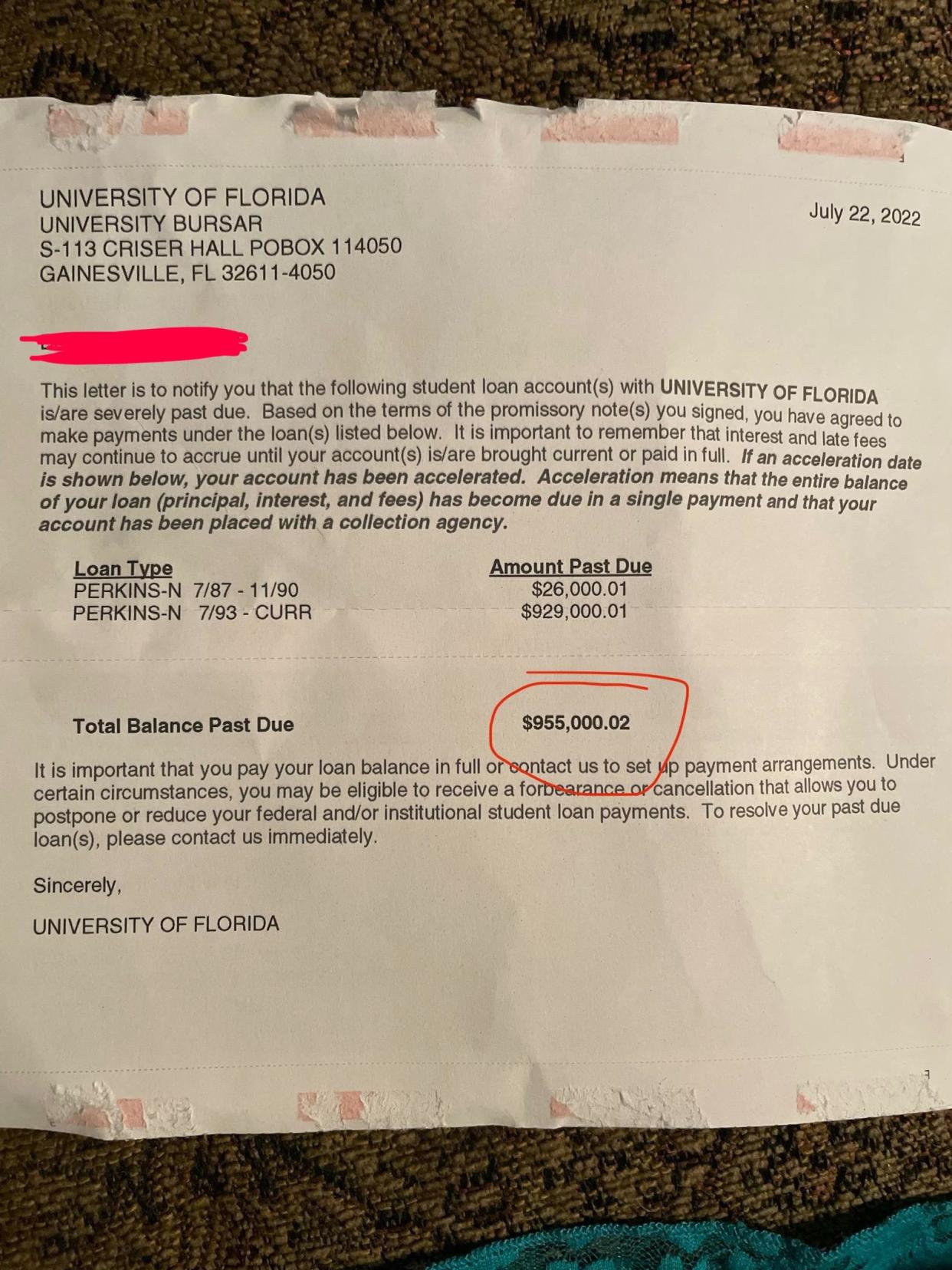

So, when Michelle opened a letter from her alma mater in July suggesting that her Perkins loan repayments were “severely past due,” she was stunned. Even more confounding than the bill itself was the amount it said she still owed the school: $955,000.02.

I actually went into depression. I went into hiding. I didn’t know how to make sense of it because it was so long ago. So now, I’m like, I’m about to retire and I’m about to lose everything.Michelle

“I actually went into depression. I went into hiding. I didn’t know how to make sense of it because it was so long ago,” said Michelle. “So now, I’m like, I’m about to retire and I’m about to lose everything.”

Michelle turned out to be wrong. Thanks in large part to an internet stranger with decades of expertise who eagerly offered to help sort through the student loan debacle, her situation changed almost overnight.

Michelle’s daughter posted the letter to Reddit — a site that Michelle said she had visited “maybe twice” in her life before — in a section dedicated to discussions about student loans. The site’s users quickly tagged one member — Betsy Mayotte, the president and founder of an organization called The Institute of Student Loan Advisors, which provides a range of free services to borrowers like Michelle.

Mayotte is a regular in the site’s r/StudentLoans subreddit, where people share personal experiences and tips as they navigate daunting repayment schedules amid changing debt relief policies under the Biden Administration, and frequently uses it to connect with people who need advice about their loans. In a comment on the original post from Michelle’s daughter, another user calls Mayotte the “GOAT,” which stands for greatest of all time.

Mayotte, having worked before with Perkins loan borrowers who had been blindsided by unexpected bills, stepped in as a liaison between Michelle and the University of Florida. The original amount was quickly determined to be a mistake. A spokesperson at the University of Florida attributed the error to a technical issue at ECSI, a company that universities hire to act as a loan servicer for former students repaying balances through the Perkins program.

While the university said in a statement that it could not comment on Michelle’s case specifically, citing records protection laws for students, the school noted that “no student at the University of Florida has ever owed” nearly $1 million in student loans.

In July, the University of Florida learned that the computer system used by the company that handles billing for the university issued statements with erroneous amounts to borrowers for many schools, including UF.University of Florida

“However, in July, the University of Florida learned that the computer system used by the company that handles billing for the university issued statements with erroneous amounts to borrowers for many schools, including UF,” the statement continued. A university spokesperson later said ECSI planned to issue new statements “reflecting the correct balances” within a week of the error coming to light.

A spokesperson at ECSI confirmed the calculation issue and acknowledged in a statement that the company “sent letters to a small number of borrowers reflecting incorrect amounts owed on their loans” over the summer.

“These letters were promptly corrected and we apologize for any inconvenience this may have caused,” the spokesperson said.

By the end of August, Michelle had received at least one of several amended statements that would ultimately come by mail from the University of Florida. The new balance still ran quite high, about $8,000, and while Michelle said she “felt better, of course, because that wasn’t a million,” she also suspected the revised number, which did not match the balance reflected in her online account, was incorrect.

After graduating with her bachelor’s degree, Michelle had applied for loan cancellation through a teaching program offered to Perkins loan recipients. It promised to cancel a portion of the borrower’s loan for every academic year spent teaching in certain schools, or certain subject areas. For example, someone who taught in a school serving students from low-income families, or taught special education, math, science or foreign language classes would be eligible for complete loan forgiveness.

Michelle fulfilled the requirements in various teaching positions held over the course of five years. She submitted the records necessary to confirm her eligibility for relief under the Perkins program guidelines, and assumed the loan was forgiven. But, when Mayotte again reached out to the university with questions about Michelle’s updated balance, she was told that Michelle’s records never arrived.

“They said they never received it,” said Mayotte. She noted that, in her experience, miscommunication is common between Perkins loan borrowers and their loan servicers, despite company policies that technically require loan servicers to send borrowers monthly notifications about their bills, especially when they are past due. Unlike other federal student loans that are managed by vendors or servicers affiliated with the Department of Education, Perkins loan servicers have historically been the universities themselves, which then outsource loan servicing tasks to a third party.

“I see all the time, people that say, ‘I haven’t had a bill for my Perkins loan in 10 years, 20 years,'” said Mayotte. “It makes it really difficult for the borrower. You know, a lot of times it’s a legit bill. But if it isn’t, what consumer keeps records for 20 years to be able to push back on that?”

ECSI did not become a loan servicer for the University of Florida until the early 2000s, years after Michelle submitted her forgiveness paperwork to the school, and the company spokesperson said it “had no involvement” in the record-keeping process that determined whether or not she was granted relief.

Her final balance turned out to be just $408

“Nevertheless, we were happy to assist the institution with the issues they had with this borrower and rectify the loan forgiveness,” the spokesperson said.

Michelle, “thankfully,” per Mayotte, was able to prove her eligibility for retroactive relief through the Perkins loan teaching program. Her final balance: $408, which, she said, was paid in full as of two weeks ago.

“The only word I had was amen when I got that letter,” Michelle said. “I couldn’t process it completely. I was just grateful.”

Although Michelle’s exorbitant student loan balance was a mistake, Mayotte said she has worked with a couple of clients before who really do owe close to $1 million for money borrowed to go to school.

A recent report published by the Education Data Initiative points to the ongoing student debt crisis in the U.S., which has proven difficult to remedy despite President Biden’s promised loan forgiveness plan — now on hold, per court order, and potentially headed to the Supreme Court. Student debt currently totals $1.745 trillion nationwide, according to the report, which places the average federal loan debt balance at just under $38,000. But, with Biden’s forgiveness plan stalled, the administration recently announced that it is extending the pause on student debt repayments until June of next year.

“Education, when financed by student loans, does not live up to its mantra as the ‘great equalizer,'” said Michelle in an email, adding that borrowers, particularly those who go on to work in the public sector, often “grow old with the burdens of student loans and are sometimes never, ever fully able to make future plans, to upgrade lifestyle, to save, to invest, or retire on time. The pay is generally too low — paycheck to paycheck — and the life cycle of loans last entirely too long.”

Chinese factory workers protest harsh COVID rules

Jamestown shores up seawall to fight flood threat

More shoppers expected to spend at small businesses

Source: Read Full Article